Maw Your Realtor Can Be Fun For Everyone

Table of ContentsOur Maw Your Realtor IdeasMaw Your Realtor Fundamentals ExplainedFacts About Maw Your Realtor UncoveredAll About Maw Your RealtorIndicators on Maw Your Realtor You Should KnowThe Maw Your Realtor PDFs

You may also battle to discover enough occupants to fill up that workplace building or retail facility you bought. House Flipping Investors who want to generate income rapidly frequently rely on house flipping. This is when you buy a residence for a reduced cost, restore it quickly and after that sell it for a quick revenue.You're not interested in regular monthly leas when turning a residence. Rather, you need to purchase a home for the cheapest feasible rate if you desire to make an excellent revenue when selling.

Expanding your financial investment portfolio is crucial. If you put all your eggs in one basket, you can endure a failure in the blink of an eye. But when you spend some funds in the securities market, various other funds in bonds or ETFs, as well as some in genuine estate, you increase your opportunities of greater earnings as well as less losses.

10 Simple Techniques For Maw Your Realtor

Neither is precise, and also to reassure you, below are 8 fantastic reasons realty is a good financial investment. The Leading Reasons Property Is a Great Financial investment If you're considering spending in property, you will begin on among the most effective investment journeys of your life time.

There aren't a lot of various other investments that permit you to purchase properties worth a lot more than you need to spend. For instance, if you have $10,000 to purchase the stock market, you can typically purchase just $10,000 worth of stock. The exemption is if you buy margin (borrow), yet you need to be an accredited financier with a high web worth to make that happen.

Allow's state you located a house for $100,000; if you place down $10,000, possibilities are you can discover a lending to fund the rest as long as you have great credit and also stable income. With that said, it indicates you invest just 10% of the asset's worth and also own it.

The 8-Minute Rule for Maw Your Realtor

Unlike supplies or bonds, you can force the real estate to value. It appears unusual, but it's possible. First, know that property appreciates naturally. On average, property values 3% 5% a year without you doing anything except maintaining the house. You can boost the price of gratitude by making restorations or repair work.

Rumored Buzz on Maw Your Realtor

When you purchase supplies or bonds, you can only cross out any resources losses if you sell the asset for less than you spent for it. If you get and also hold realty, you can make regular monthly cash flow leasing it out, and also this enhances the make money from owning actual estate considering that you aren't relying only on the recognition however the month-to-month rental revenue. maw your realtor.

Roofstock Marketplace is a fantastic source. They not just checklist offered financial investment homes to buy, however much of them have occupants with leases in location already. When you get the home, you quickly become a landlord. Roofstock additionally uses a lot of due diligence, researching you, so all you need to do is buy the residential property you think is finest.

There's not much to really feel secure concerning when you spend in the market. When you spend in actual estate lasting, you know you have a valuing property.

An Unbiased View of Maw Your Realtor

Numerous individuals invest in property to supplement their retirement revenue. Whether you own the residential property while you're retired, making the monthly rental capital to supplement your income, or you offer a home you've owned for several years once you're in retired life and also make a profit, you'll boost your retired life earnings.

If getting actual estate as well as renting it out is also stressful for you, there are numerous other ways to buy property, including: Get an undervalued home, repair it up and also flip it (fix as well as flip) Be a dealer functioning as the center male between inspired sellers as well as a network of buyers.

Spend in a Realty Financial Investment Trust If you wish to leave a tradition behind but don't assume going money is a good suggestion, passing realty down can be also better. Not only will you give your heirs an income-producing property, yet it's also an appreciating asset. So they can either maintain the residential property and also let the tradition proceed here are the findings or offer it as well as gain revenues.

The Ultimate Guide To Maw Your Realtor

For example, let's claim you have $50,000 equity in a residence. You can refinance the mortgage on it, secure the $50,000, and utilize it as a deposit on your next residential or commercial property. Depending upon the worth of your properties, you may even be able to pay money for future properties, boosting your portfolio and also the equity in it also quicker.

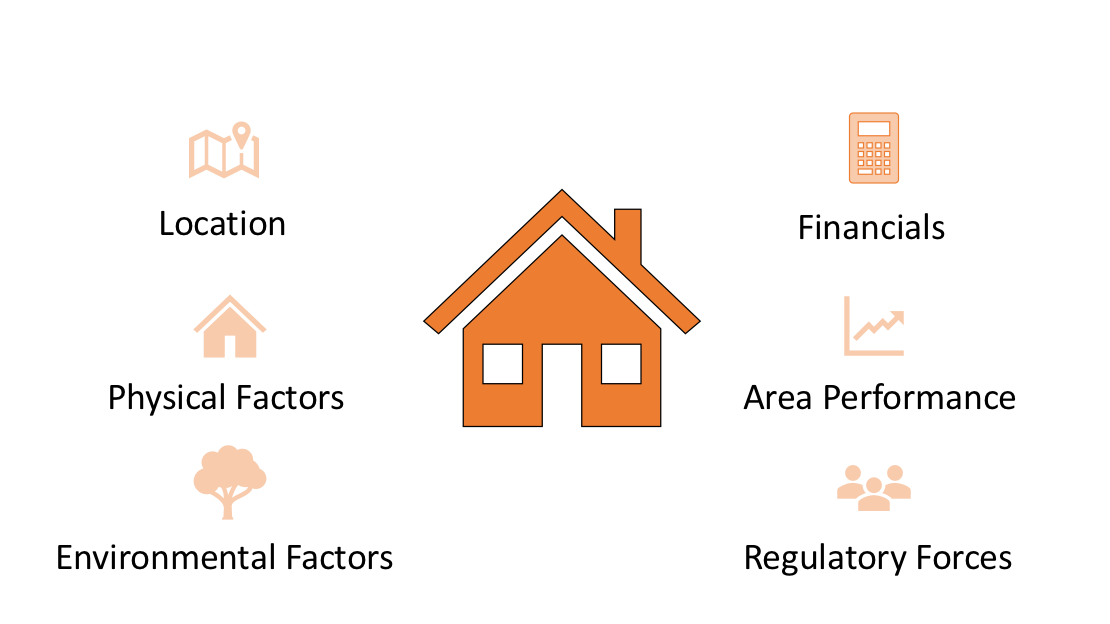

While there's not a one-size-fits-all response, there are specific credit to try to find when you news buy property, consisting of: Search for an area that's attractive for renters or with quick valuing homes. Ensure the location has all the amenities and conveniences most property owners desire Consider the area's crime price, college rankings, and tax obligation background.